Consequences of Buying at the Peak in a Seller’s Market

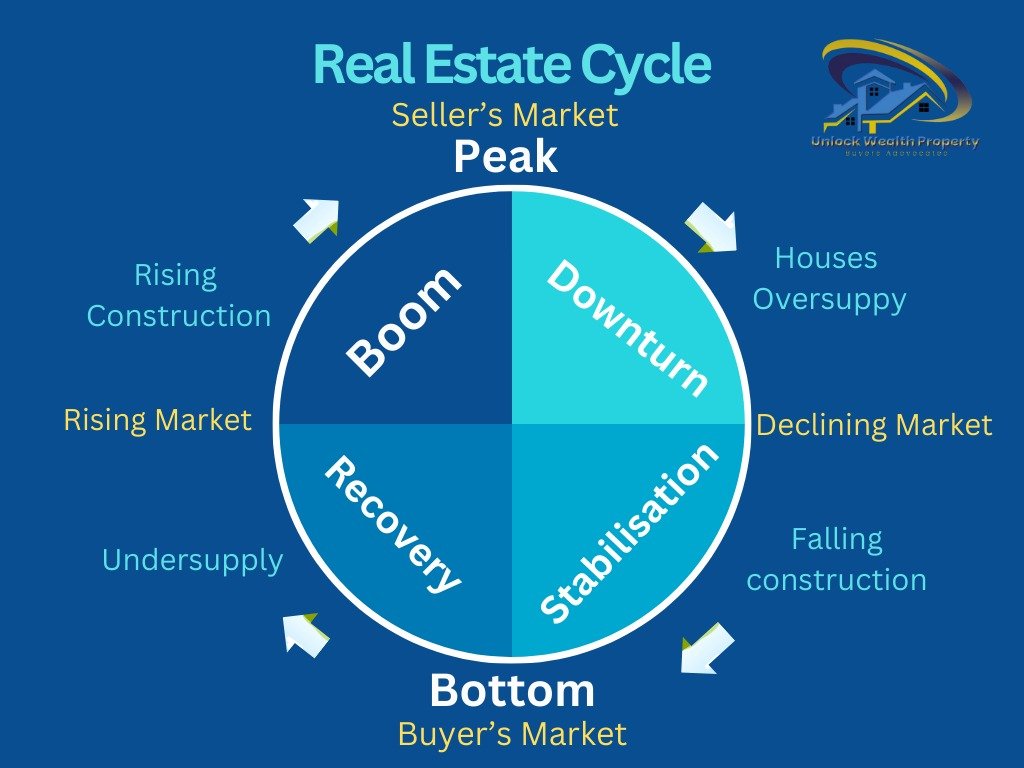

most significant mistake a property investor can make can adversely affect their investment journey: Buying your Investment property at the peak of the property cycle

Consequences of Buying at the Peak in a Seller’s Market

1. Overinflated Prices

In a seller’s market, demand outstrips supply, often driving property prices to unprecedented highs. When you buy at peak prices, you risk overpaying for a property. This can lead to negative equity, where your mortgage exceeds the property’s market value, especially if the market corrects itself.

2. Increased Competition

In a competitive environment, buyers may feel pressured to make hasty decisions. This can lead to purchasing properties that may not meet long-term needs or purchasing properties without adequate inspections and due diligence. The fear of missing out (FOMO) can cloud judgement and lead to less favourable outcomes.

3. Limited Negotiation Power

Sellers hold the advantage in peak markets, leading buyers into bidding wars that drive up prices. Consequently, buyers may need to waive essential contingencies like building and pest inspections, risking exposure to unforeseen issues.

4. Potential for Market Correction

Real estate markets may correct after growth, causing short-term losses for investors reliant on property for income or capital growth.

5. Financing Challenges

Buying at peak prices strains finances. Higher loans may lead to stricter lending and increased repayments, affecting cash flow and stability.

6. Emotional Strain

Committing financially in a competitive market can cause stress and buyer's remorse if prices fall or appreciation expectations aren't met.

7. Impact on Future Purchases

Buying at peak prices limits future investment options. Stretching budgets for a home may hinder other investments or future upgrades.

Conclusion

Buying in a booming market can be tempting, but understanding the risks of purchasing at the peak is crucial to avoid costly mistakes. Buyers should consult professionals like buyer's advocates, brokers, and financial planners to navigate these challenges and make strategic decisions aligned with long-term financial goals.

Signs of a Poor Investment Decision

Rapid Price Decline: A swift drop in property values post-purchase signals an unsustainable market peak.

Extended Time on Market: Comparatively, sluggish sales for similar properties indicate a possible correction phase in the market.

Increased Vacancy Rates: Higher rental vacancies point towards declining demand, affecting your rental income.

Negative Cash Flow: If rental income fails to cover your expenses, it's a clear sign of an unfavorable buying moment.

Strategies to Bounce Back

Seek Professional Guidance: A buyers advocate offers expertise to navigate market turbulence with tailored insights and strategies.

Market Analysis: Regularly assess market trends to make timely decisions on selling, holding, or investing.

Diversify Your Portfolio: Expanding your investment portfolio can mitigate risks associated with a single property.

Leverage Financing Options: Consider refinancing your mortgage or exploring other financing options to improve cash flow.

Hold Long-Term: If market conditions are not favorable for selling, consider holding the property longer to wait for market recovery.

By staying informed and engaging with professionals in the field, you can enhance your resilience and navigate the complexities of property investment, even when entering the market at a challenging time.

Disclaimer: The information provided herein is general in nature only. No financial, legal, or tax advice is provided, and it should not be relied upon as such. Always consult with a qualified professional for specific guidance tailored to your circumstances.